In the previous article on the History of Futures, we saw that in Japan, trading of commodity futures go back to the 16th century. If they were trading futures even back then, then the trading should be pretty simple right? Wrong!

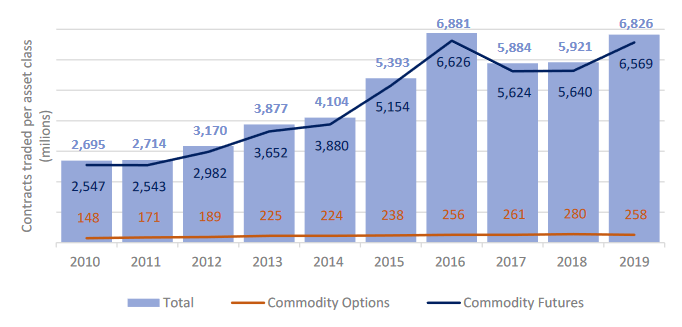

Commodity trading is one of the most widespread types of derivatives trading. In 2019, about 6.8 billion commodity derivative contracts were traded. About 95% of these contracts were commodity futures.

So what is so special about commodity futures that makes it the oldest but also not-so-simple derivatives? The answer is in how it is actually delivered.

Difference between commodity futures and stock/index futures

On our article about understanding what is a future, we discussed that when you sell a stock future, you have an agreement to deliver the underlying stock. Stocks can be bought and sold via a stock market, where ever you are in the world. All you need is a arrangement with a broker and a good internet connection. But what if you are buying and selling commodities?

You can buy and sell commodities in markets similar to stock exchanges as well. Besides, most people today order many of their household items and food over the internet right? Once you order something through the internet, there will be some courier or a delivery person who will bring it to you. Of course, it doesn’t happen instantly, there will be some time taken to delivery it. In addition to the price of the good that you bought, you will also pay a delivery fee.

Commodity trading and commodity futures trading also have similar characteristics. When you buy a corn future to deliver 5000 bushels at 5$ per bushel, it is similar to ordering 5000 bushels over the internet. But unlike when you order some day-to-day goods, you will have to send this to a warehouse. So in addition to the delivery fees, you will also pay a fee to the warehouse to store corn.

Cash settlement and physical settlement

Before we get in to the details of commodity futures, it is important to understand the difference between cash settled and physically settled futures.

In our previous examples, we saw that when we sell a future, we have to deliver the underlying on the day of the expiry. Similarly if you buy a future, you have an obligation to buy the underlying from the seller. (Read our article What is a Future? to get a refresher on futures.)

Let’s say you bought a ABC future at the price of 12 USD. Let’s consider these two scenarios on the day of the expiry:

Market price of ABC is 15 USD:

As a buyer of the ABC future, you can buy they share from the seller at 12 USD. You can then sell the share immediately in the market making 3 USD profit.

Market price of ABC is 9 USD:

As a buyer of the ABC future, you still have to buy it from the seller at 12 USD. You are overpaying the seller 3 USD over the market price. Therefore your loss is 3 USD.

In a physically settled future, a buyer will receive the underlying. But in a cash settled future, a buyer (or the seller) will receive the economic benefit based on the price of the future and the price of the underlying.

What’s special about commodity futures?

Commodity futures which are cash settled are no different from other cash settled futures, like equity. If you buy a future, on the day of the difference, you get the difference between the market price and the price you traded the future on the expiry date. If the market price is higher, the buyer makes a profit and if the market rate is lower, the seller makes a profit.

When it comes to physical delivery, commodity futures start seeing a lot more complexities. Let’s go back to the example of ordering something off the internet. In addition to the cost of goods, you will have to pay for delivery. This is an added cost. The delivery will also not be instantaneous, there will be some time taken to deliver.

Delivery cost

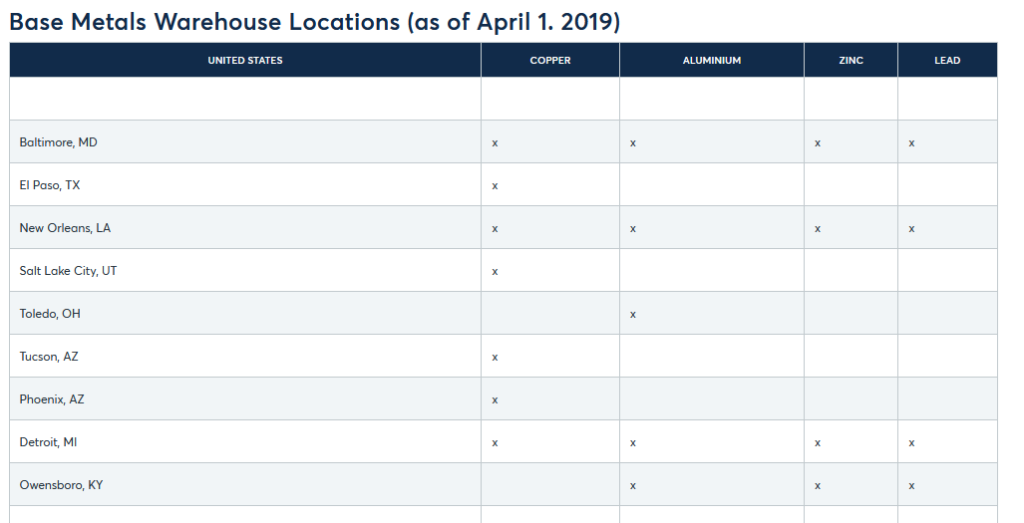

Similarly when you buy a commodity future, the traded price is only the price of the commodity. It does not include the delivery cost. But here’s a question, where do these commodities get delivered to? It’s certainly not to your own doorstep! Commodity exchanges work with or operate their own warehouses. These warehouses may store a particular type of commodity or even a sub-type only.

The sellers will deliver the commodity to these warehouses. Obviously based on the distance to each of these warehouses, the cost of delivery will differ. So how do you account for that?

All commodities have a “standard” warehouse that is specified in the contract. Depending on how far each warehouse is from the standard warehouse, a delivery “premium” is added to the price.

Grade differentials

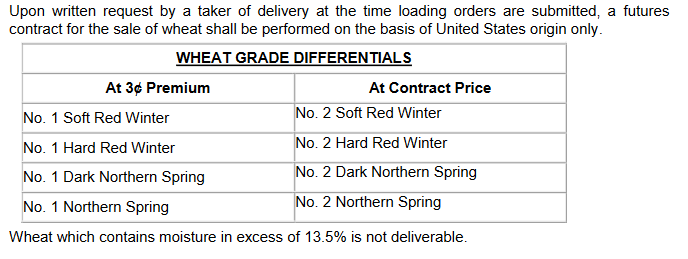

Unlike when you order a phone over the internet, commodities have different levels of quality. This could be the type of crop, the amount of impurities in a metal ore, the level of fat in meat etc.

Just like the case of a “standard” warehouse, the contract specifies a “standard” grade and other grades that can be delivered. If a seller delivers the standard grade, they receive the same price as the traded price of the contract. However if a seller delivers a grade above the standard grade they will receive a premium over the traded price. Some exchanges also allow delivery of a slightly lower grade at a discount as well.

Weight and other tolerances

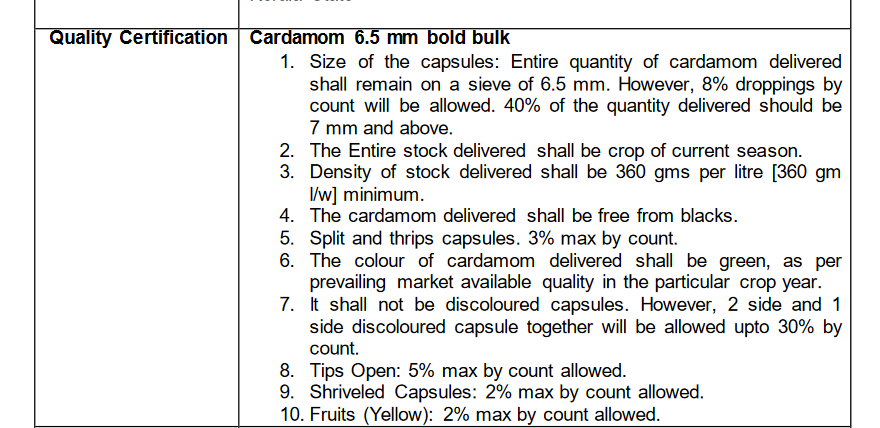

When delivering commodities, it is difficult to deliver the exact amount of commodities. Similarly the quality of a commodity can also slightly vary. Many physical factors like moisture, cutting block sizes, impurities etc. play a big role in these changes in the delivery quality. However as a buyer you would expect it to be of a certain quality. Besides who would want to pay for top grade wheat only t receive a train car full of soggy grain?

Commodity exchange specify very strict controls of commodity contracts. Warehouses who receive the deliveries from sellers, evaluate the commodity against the specifications. Sellers who fail to deliver to the expected level of quality can be charged a penalty.

Summary of it all

As you can see, the commodities which are physically delivered bring in a lot more complexity in to futures trading. Buyers and sellers need to be aware not only about the pricing, but also the additional costs and the quality of the commodities.

Regardless of all that, commodities futures make up a large part of the futures contracts traded in the world. The reason is pretty simple, the world runs on commodities!